SuperStream

Re: SuperStream – Changes to reporting regulations and payment for superannuation contributions

The SuperStream standard is part of the Australian government’s Super Reform package. It will provide a consistent, reliable electronic method of transacting linked data and payments for superannuation. The goal is to improve the efficiency of the superannuation system, to improve the timeliness of processing of rollovers and contributions, and reduce the number of lost accounts and unclaimed monies.

The standard requires employers to:

– Send all data electronically ( for example employee’s details and the amount of super being paid) in a standard format

– Make super contribution payments electronically. Cheque payment will no longer be accepted.

– Link data and money with a unique payment reference number

– Ensure data and payments are sent on the same day

– Respond to fund requests for complete information within 10 business days

Large and medium employers (with 20 or more employees) will need to start using the SuperStream standard for sending contributions to funds from 1 July 2014 and will have until 30 June 2015 to complete their implementation.

A small business, with less than 20 employees, will begin to use the SuperStream standard for contributions from 1 July 2015.

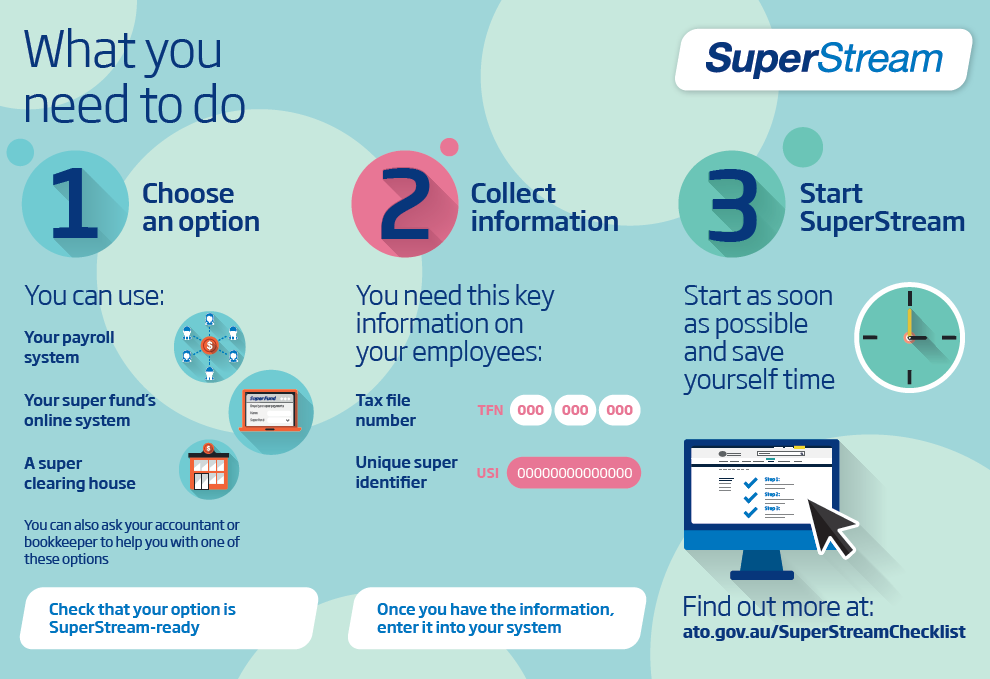

Due to the complexities associated with these changes, it is strongly suggested that you utilise the services of a superannuation clearinghouse or the payroll software to process your superannuation payments to ensure your compliance with SuperStream.

If you have less than 20 employees you can utilise the Small Business Superannuation Clearinghouse, it is a free service administered by the Australian Taxation Office.